Investment Corporation Institutions/Management Structure

- HOME

- Governance Initiatives

- Investment Corporation Institutions/Management Structure

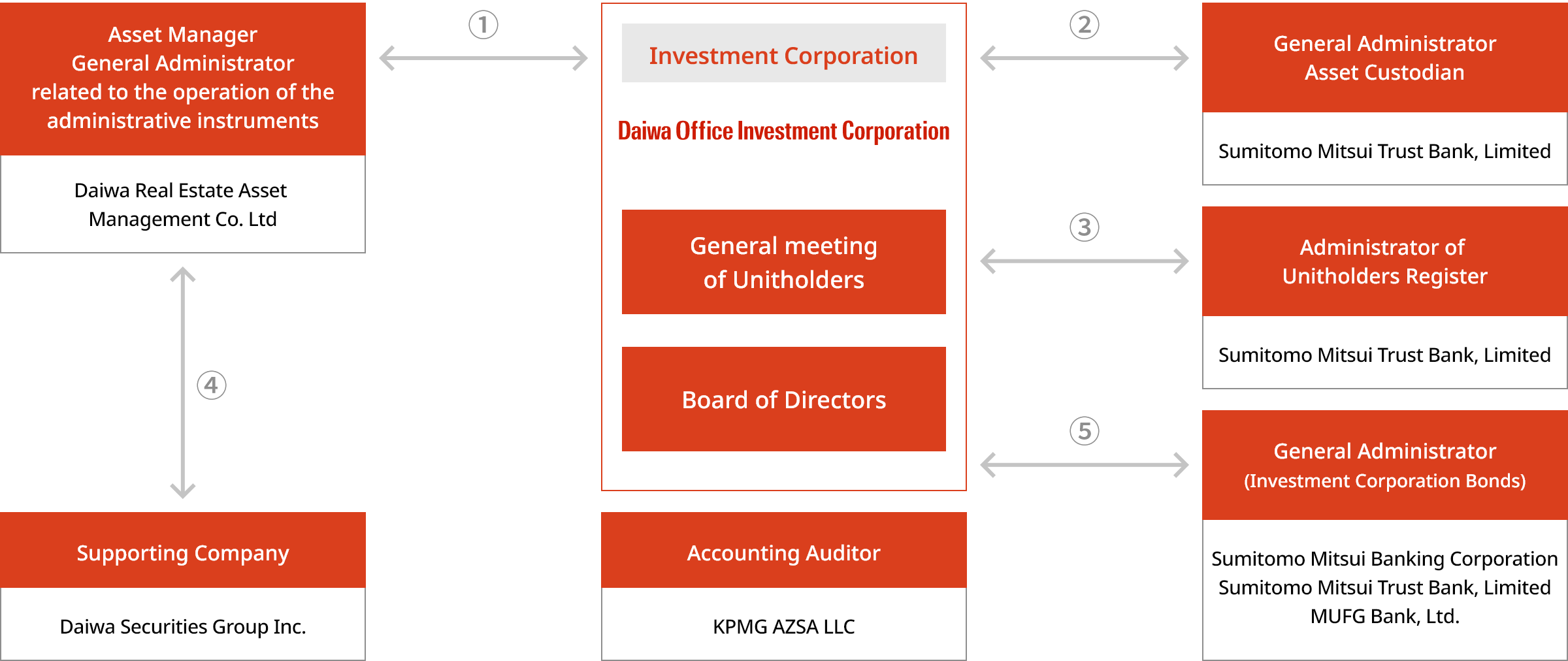

Investment Corporation Institutions

In addition to the General Meeting of Unitholders composed of investment unitholders, the Investment Corporation’s institutions include a Board of Directors, composed of one executive director and two supervisory directors, and an Accounting Auditor.

Institutions

(a)General Meeting of Unitholders

Certain resolutions, which are stipulated in the Act on Investment Trusts and Investment Corporations or the articles of incorporation, are adopted at the General Meeting of Unitholders.

Unless otherwise stipulated in the law or articles of incorporation, resolutions of the General Meeting of Unitholders shall be adopted by a majority of the voting rights of the unitholders present. However, for certain important matters such as amendments to the articles of incorporation, resolutions (special resolutions) must be adopted by two-thirds or more of the voting rights of the unitholders present at a meeting where unitholders holding a majority of the investment units issued and outstanding are present.

(b)Executive Director, Supervisory Directors & Board of Directors

The executive director has the authority to execute the business of the Investment Corporation and to represent the Investment Corporation in all judicial or extrajudicial acts related to its business. The supervisory directors have the authority to supervise the executive director's execution of duties. The Board of Directors, which is composed of all executive directors and supervisory directors, has the authority to approve the execution of certain duties, the authority stipulated in the Investment Trust Act and the articles of incorporation and the authority to supervise the executive director's execution of duties.

(c)Accounting Auditor

The Investment Corporation has appointed KPMG AZSA LLC as its accounting auditor. The Accounting Auditor shall audit the Investment Corporation's financial statements, report to the supervisory directors any wrongful act or material fact in violation of the law or articles of incorporation it discovers in connection with the executive director's execution of duties, and perform other legally stipulated duties.

Structure

- Asset managemen contract / General administrative contract related

- General administrative affairs contract / Asset custodian contract

- Unitholder register, etc. management contract / Spesial account management contract

- Sponsor support agreement

- Fiscal agency agreement

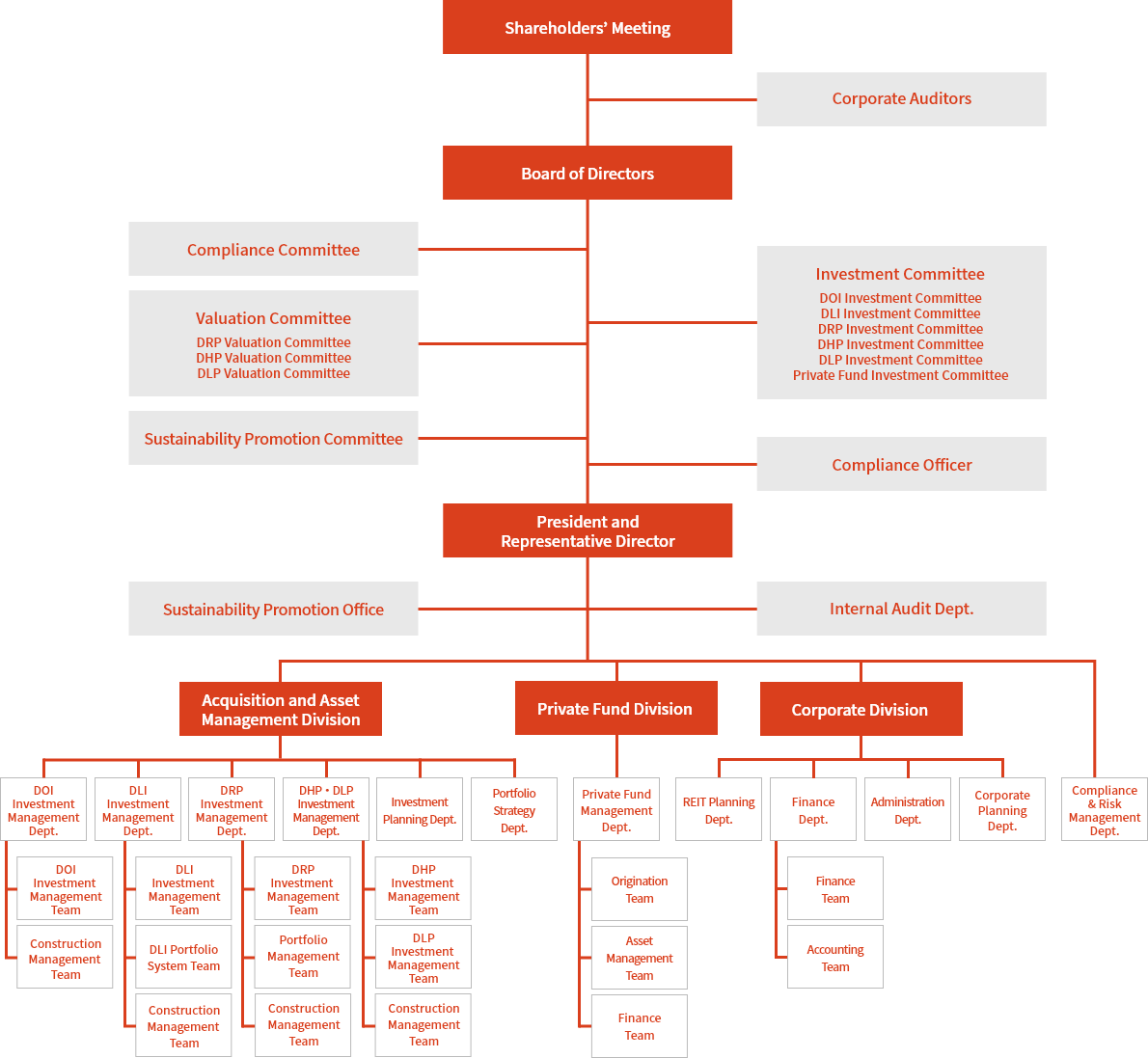

Investment Corporation Management Structure

The Investment Corporation entrusts its asset management to Daiwa Real Estate Asset Management Co., Ltd. The Asset Manager’s organizational structure is as follows.

Performance-Based Management Compensation

| Basis of the calculation | Fee rate | |

|---|---|---|

| Management Fee Ⅰ (based on assets under management) |

Total appraisal value of assets under management (based on market value) |

0.05% |

| Management Fee Ⅱ (rent revenue standard) |

Rent revenue | 5.5% |

| Management Fee Ⅲ (based on distributable amount) |

Distributable amount | 3.5% |

| Management Fee Ⅳ (asset acquisition standard) |

Acquisition price of target real estate | 0.75% |

| Management Fee Ⅴ (asset sale standard) |

Transfer price of target real estate | 0.5% |