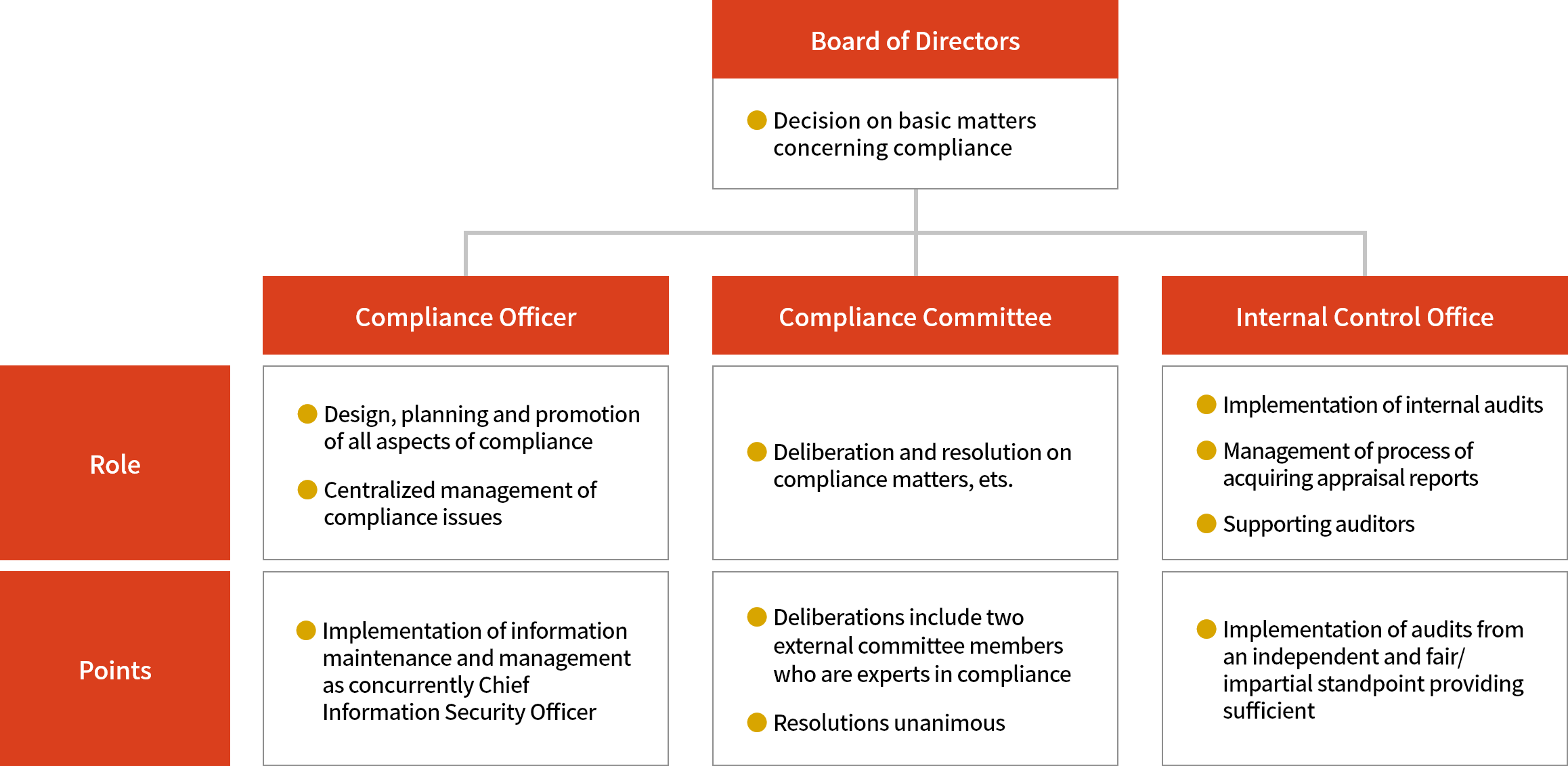

Compliance Structure

- HOME

- Governance Initiatives

- Compliance Structure

Compliance Structure

The Asset Manager is committed to honest and fair corporate activities, not only in strict compliance with all laws and regulations related to its operations, various regulations, bylaws and market rules but also in full awareness of social norms.

Appropriate Management of Conflicts of Interest

In cases where transactions may be at risk of conflicts of interest concerning the financial instruments business or other related operations, the Asset Manager shall comply with the Financial Instruments and Exchange Act, the Act on Investment Trusts and Investment Corporations and other related laws and regulations, and the separately provided rules on measures against conflicts of interest. The rules on prevention of conflicts of interest provide the following terms and conditions individually for each of the following transactions:

1) Asset Acquisition

In case of acquiring real estate or real estate trust beneficiary rights from interested parties, the acquisition price shall be at 100% or less of the appraisal value as appraised by a real estate appraiser. In the case of other assets, the acquisition shall be made at fair value price. However, if the fair value measurement is not applicable, the acquisition shall be at the value reasonably estimated by an expert independent from the asset management company.

2) Other

In cases other than asset acquisition, such as asset sale, asset leasing, entrustment of property management operations, entrustment of intermediation operations for real estate acquisition, sale or leasing and placement of construction orders, where such involves interested persons, the transaction shall be implemented in line with the rules on measures against conflicts of interest.

Investment decision-making system

As an asset management company under the Act on Investment Trusts and Investment Corporations that is entrusted with asset management by the Investment Corporation, the Asset Manager prepares, in line with the Articles of Incorporation, asset management guidelines to stipulate basic approaches to investment management, such as the investment policy, rules on transactions with interested parties regarding acquisition and sale of assets, etc. and the disclosure policy.

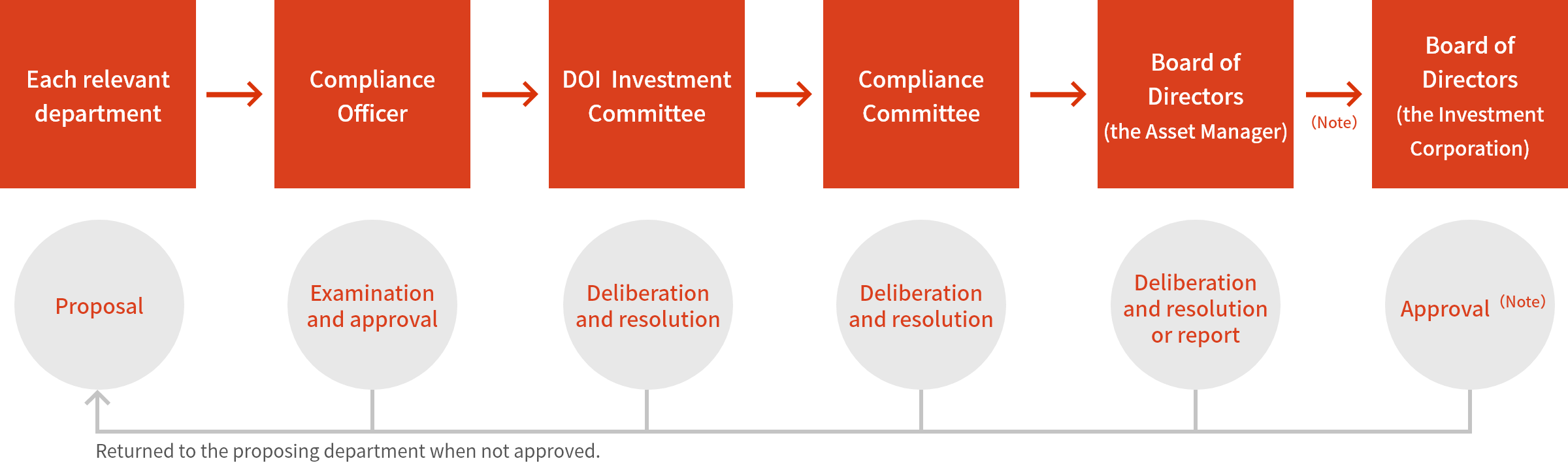

Decision-making process

- When transacting (acquiring or transferring real estate or securities, or leasing) with interested persons under the Act on Investment Trusts and Investment Corporations, approval by the Board of Directors of the Investment Corporation is required except for certain cases.

Note that a proposal shall be returned to the proposing department when examination by the Compliance Officer or deliberation by the DOI Investment Committee, Compliance Committee or Board of Directors results in approval not being obtained. In addition, for agenda resolved at a meeting of the DOI Investment Committee, Compliance Committee or Board of Directors, parties having special vested interest shall not be eligible to exercise voting rights on the concerned resolved agenda.

Prevention of Conflicts of Interest among Funds

In case of competition over a property acquisition opportunity among the Investment Corporation and other funds, etc. managed by the Asset Manager, conflicts of interest among the Investment Corporations and other funds, etc. shall be prevented by first granting the Investment Corporation the preferential right to consider the acquisition. The acquisition opportunity will be available to the other funds, etc. only when the Investment Corporation decides not to exercise the concerned preferential right.

Furthermore, in the case of rental residences, the Asset Manager shall prevent arbitrary distribution of property information and avoid conflicts of interest among Daiwa Residential Private Investment Corporation, Daiwa Securities Living Investment Corporation and other funds, etc. by establishing the "Rotation Rule."

Establishment of Tax Policy

Daiwa Securities Group has enacted "Daiwa Securities Group Tax Policy" in aiming to develop corporate tax governance, and describes our code of conduct and standard of judgments in taxation.

For details, please click here.

Prevention of corruption

In line with the principles of the United Nations Global Compact, Daiwa Securities Group works to prevent corruption. The Code of Ethics and Conduct, which guides the actions of officers and employees, stipulates that if corporate ethics and interests conflict with each other, corporate ethics should be prioritized and acts contrary to corporate ethics should never be performed. In addition, payment of any money or provision of convenience that is against the law is prohibited. Moreover, we prohibit the provision and receipt of economic benefits that may not be valid in the light of common wisdom, such as cash rewards and excessive entertainment. For entertainment, we apply and manage in accordance with management rules on entertainment, and we have set special precautions especially for entertainment with government officials including those from foreign governments. In order to thoroughly prevent corruption, we carry out educational activities for employees, such as conducting ethics training based on the Code of Ethics and Conduct every year, and monitor the status of entertainment.

For details, please click here.

Officers

DOI's Articles of Incorporation stipulate that the maximum amount of remuneration for executive directors and supervisory directors shall be 800,000 yen per month per person and 500,000 yen per month per person, respectively, as determined by the Board of Directors. A resolution of the general meeting of unitholders is required for any change.

(Fiscal Period ended May 2022)

(Unit: thousand yen)

| Title | Name | Concurrent positions | Total Compensation for Positionin This Period |

|---|---|---|---|

| Executive Director | Seiya Miyamoto | - | 3,000 |

| Supervisory Director | Takayuki Hiraishi | Attorney at Spring Partners Audit & Supervisory Board Member at Delivery Consulting Inc. |

4,200 |

| Hiroshi Sakuma | CPA/tax accountant at Sakuma CPA Firm Director at Just Planning Inc. |

(Fiscal Period ended November 2022)

(Unit: thousand yen)

| Title | Name | Concurrent positions | Total Compensation for Positionin This Period |

|---|---|---|---|

| Executive Director | Keiichi Sakai | - | 3,000 |

| Seiya Miyamoto | - | ||

| Supervisory Director | Daisuke Eki | Attorney at Ishii Law Office | 4,200 |

| Koichiro Ito | Representative of Ito International Accounting and Taxation Office Auditor of VISITS Technologies Inc. Director of ACT Holdings, Inc. Auditor of Jibannet Holdings Auditor of moi Corporation Director and Audit Committee Member of e-Seikatsu Co., Ltd. |

||

| Takayuki Hiraishi | - | ||

| Hiroshi Sakuma | - |

- Effective August 26, 2022, Seiya Miyamoto resigned as Executive Director and Keiichi Sakai assumed the position. Also, as of the same date, Supervisory Directors Takayuki Hiraishi and Daisuke Eki resigned as supervisory directors and Koichiro Ito were appointed as supervisory directors.

Click here for career summaries.

Accouting Auditor Compensation(DOI)

DOI's Articles of Incorporation stipulate that the standard for payment of remuneration for the accounting auditor of DOI shall be up to 20 million yen for each fiscal period subject to audit, an amount to be determined by the Board of Directors. A resolution of the general meeting of unitholders is required to change the standard.

(Unit: thousand yen)

| Name | Description of compensation | Total compensation (Fiscal Period ended May 2022) |

Total compensation (Fiscal Period ended November 2022) |

|---|---|---|---|

| KPMG AZSA LLC | Compensation based on auditing duties | 15,750 | 15,750 |

Whistleblowing System

The Asset Manager has established a whistleblowing system for all employees (part-time, contract, seconded from other companies and temporary).

This system enables anonymous reporting and, in compliance with the Whistleblower Protection Act, prohibits firing, disciplining, retaliating against or subjecting the whistleblower to any other disadvantageous treatment on account of their report.

Protection of information assets

The Asset Manager has established Rules for the Protection of Information Assets with the aim of properly utilizing corporate information and preventing unauthorized access and loss or leakage of corporate information.

The regulations ensure thorough information management by stipulating the management of confidential information, access restrictions for outsiders, prevention of information leaks, maintenance of information systems and education and audits related to information system management.

Regular Compliance Training

The Asset Manager regularly conducts training for all employees (part-time, contract, seconded from other companies and temporary) to raise compliance awareness.

Same-Boat Investment

| Sponsor group | Number of units | Holding ratio |

|---|---|---|

| Daiwa Investment Management Inc. | 128,905 units | 26.95% |

| Daiwa Securities group Inc. | 67,321 units | 14.08% |

- As of end of period ended May 2023