Green Finance

- HOME

- Green Finance

The Investment Corporation has established the Green Finance Framework under the belief that providing investment opportunities for investors who are active in ESG investment through green financing is of social significance.

The Investment Corporation has received Green 1(F), the highest rating in “JCR Green Finance Framework Evaluation” from Japan Credit Rating Agency, Ltd. as a third-party evaluation for the Green Finance Framework.

-

JCR Green Finance Framework Evaluations related to the Investment Corporation are described on the JCR website below.

https://www.jcr.co.jp/en/greenfinance/green/

Green Finance Framework

1.Use of Procured Funds

Funds raised through green bonds or green loans will be used to acquire properties that meet the following eligible criteria or to refinance the funds.

【Eligible criteria】

Properties which have received or will receive any of the following certifications from third-party certification bodies

| DBJ Green Building Certification | 3 Stars, 4 Stars or 5 Stars |

|---|---|

| CASBEE for Buildings | B+ Rating, A Rating or S Rating(CASBEE-Building (new construction), CASBEE-Real Estate, CASBEE for Municipalities) |

| BELS Certification | 3 Stars, 4 Stars or 5 Stars |

| LEED Certification | Silver, Gold or Platinum |

2.Evaluation/selection Process of Projects

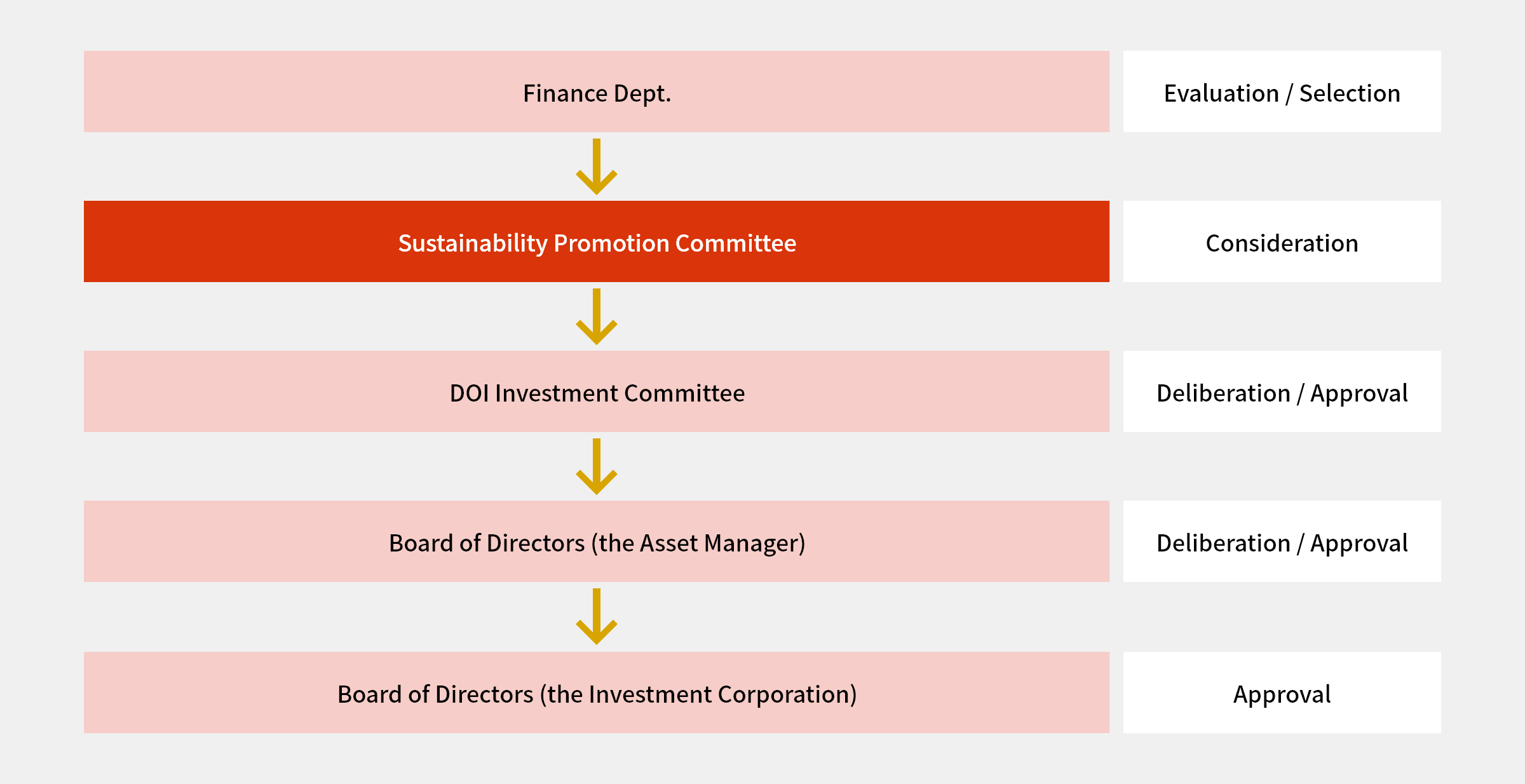

Under the advice of the asset manager of the Asset Manager, the Finance Department will consider the suitability for eligible criteria, and then evaluate and select the projects.

Raising funds through green financing for the project is examined by the Asset Manager’s Sustainability Promotion Committee, deliberated by the DOI Investment Committee and the Board of Directors, and approved by the Board of Directors of the Investment Corporation.

【Selection process of projects】

3.Management of Procured Funds

Setting the total acquisition price of eligible green assets as the maximum issuance amount of green bonds, the Investment Corporation manages so that, as long as there is an unredeemed balance of the relevant green bonds, the total amount of the outstanding green bonds does not exceed the total acquisition price of eligible green assets.

In addition, the Investment Corporation internally tracks and manages the allocated funds for each portfolio asset as long as there is an unredeemed balance of the relevant green bonds. In the case where all or part of the net proceeds of the green bond is not immediately allocated to eligible green assets, the Investment Corporation first identifies such unallocated funds, and then manages all or part of the funds in cash and cash equivalent until such is allocated to eligible green assets.

4.Impact Reporting

As long as there is an unredeemed balance of the relevant green bonds, the Investment Corporation will annually disclose allocation, the number of the buildings of eligible green assets and environmental performance indices on its website. The reporting as of May 31, 2023, is as follows.

(Allocation Reporting)

The Investment Corporation confirmed that the net proceeds of the green bonds are fully allocated to eligible green assets in accordance with its Green Bond Framework, and that the total amount of the outstanding green bonds does not exceed the total acquisition price of eligible green assets.

| Total amount of the outstanding green bonds | 3,900 million yen |

|---|---|

| Total acquisition price of eligible green assets | 291,806 million yen |

| Total issue amount (million yen) |

Interest rate | Issue date | Redemption date | Issue period | Allocation status | |

|---|---|---|---|---|---|---|

| Seventh Series of Unsecured Investment Corporation Bonds | 1,500 | 0.310% | September 11, 2020 | September 11, 2025 | 5 years | Fully allocated to part of the repayment funds for short-term borrowings for the acquisition of Daiwa Harumi, one of the eligible green assets |

| (Green bond) | Eighth Series of Unsecured Investment Corporation Bonds | 2,400 | 0.600% | September 11, 2020 | September 11, 2030 | 10 years |

| (Green bond) | ||||||

| Total | 3,900 | - | - | - | - | - |

(Impact Reporting)

- The number of the buildings, the total amount of the floor area of eligible green assets

| FY2022 | ||

|---|---|---|

| CASBEE for Real Estate | 29 | 260,801.23㎡ |

| DBJ Green Building Certification | 2 | 82,282.76㎡ |

| BELS | 1 | 4,293.73㎡ |

| Portfolio Total | 31 | 305,386.83㎡ |

- Aggregated for Green Qualifying Assets for which DOI has energy management authority.

- For sectional ownership buildings, the total floor area is calculated based on the ownership ratio of the Investment Corporation.

- Quantitative indicators regarding eligible green assets

| FY2022 | |

|---|---|

| Energy Consumption | 50,630MWh |

| CO2 emissions | 24,188t-CO2 |

| Water consumption | 205,821m³ |

- Calculated based on data of eligible green assets for which the Investment Corporation has energy management authority from April 2020 to March 2022.